Life insurance is one of those things that can easily slip under the radar once you set it up. But over time, your life changes—so should your coverage. Whether you’ve experienced a major life event or your financial circumstances have shifted, reviewing your life insurance policy is an essential part of protecting your future and the well-being of your loved ones.

In this post, we’ll explore why and how you should regularly review your life insurance, and what steps to take to ensure you have the coverage you need.

Why You Need to Review Your Life Insurance

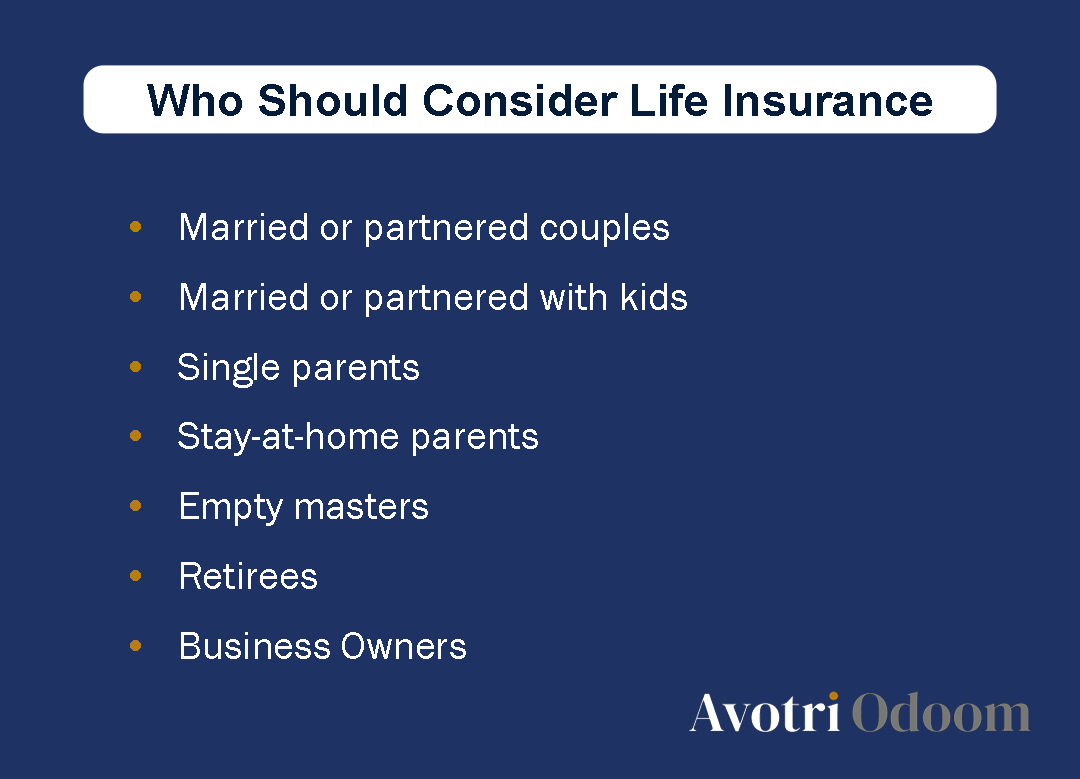

Life insurance is designed to provide financial protection for your beneficiaries in the event of your death. But as your life evolves—whether due to marriage, children, career changes, or other significant milestones—the coverage you initially chose may no longer be adequate. If your life insurance policy isn’t updated to reflect these changes, you could end up underinsured, which can leave your family vulnerable.

According to the National Association of Insurance Commissioners (NAIC), failing to regularly review your policy is one of the top mistakes policyholders make. An outdated policy could mean missed opportunities to optimize your coverage for your current needs.

When Should You Review Your Life Insurance?

While there’s no fixed rule for how often you should review your policy, certain life events are strong indicators that it’s time for an update. Consider reviewing your life insurance after any of the following:

- Marriage or Divorce: These life changes can affect your financial situation and dependents.

- New Child or Dependent: Adding a child or taking on new caregiving responsibilities can change how much life insurance you need.

- Change in Income: A significant increase or decrease in your income may necessitate a change in your coverage.

- Buying a Home or Other Significant Assets: Larger financial commitments require more comprehensive protection.

- Change in Health: If your health has improved or declined, it might be time to adjust your policy.

For more on life events and when to adjust your coverage, see this comprehensive guide from Investopedia on why life insurance policies should be reviewed regularly.

What to Look for When Reviewing Your Life Insurance Policy

A simple life insurance review can ensure that your policy still meets your needs. Here’s a checklist of factors to consider during your review:

1. Coverage Amount

Does the face value of your policy align with your current financial responsibilities? Ideally, your life insurance should cover all debts (like mortgages and loans), living expenses for your dependents, and any final expenses. If your circumstances have changed—such as buying a house or starting a family—your coverage should increase.

2. Beneficiaries

Make sure the beneficiaries listed on your policy reflect your current wishes. Divorce, marriage, or the birth of children often require updates to the beneficiaries on your policy.

3. Policy Type

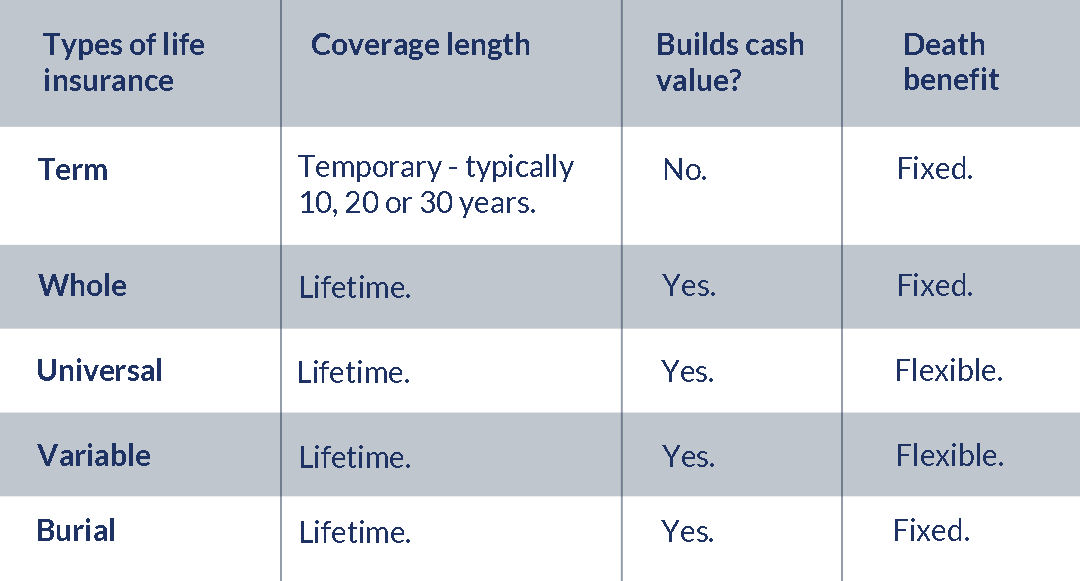

There are various types of life insurance: term life, whole life, universal life, and more. It’s important to assess whether the policy you have is still the best fit for your needs. For instance, if you initially purchased term life insurance and are now considering whole life or universal life, this may be a good time to explore different options.

Learn more about the differences between these policy types from NerdWallet’s guide to understanding life insurance types.

4. Premiums

Check whether your premiums have changed or are due to change in the near future. Some policies, like term life insurance, may have increasing premiums as you age. If you’re facing a premium increase, it may be worthwhile to shop for a new policy.

5. Riders

Review any additional coverage options, such as critical illness or disability riders, that are attached to your policy. Riders can offer valuable extra protection, but it’s important to ensure they still match your needs.

How to Review Your Life Insurance Policy

When you’re ready to review your policy, here’s a step-by-step guide to help streamline the process:

Step 1: Gather Your Documents

Start by collecting your life insurance policy and any other financial documents that will help you assess your current situation (like tax returns, financial goals, and budget summaries).

Step 2: Evaluate Your Coverage Needs

Consider your current life circumstances and compare them to your policy’s coverage. Do you have new dependents? Have your debts increased? Review the checklist above to help you determine if your coverage is adequate.

Step 3: Consult with Your Insurance Provider

Contact your insurance company to discuss your policy. Ask about potential changes in premium rates or available riders, and inquire if there are other policies that better fit your current needs.

Common Mistakes to Avoid When Reviewing Life Insurance

- Delaying the Review: Don’t put off reviewing your policy until it’s too late. Regular reviews (at least every 1-2 years) are crucial for ensuring you’re fully protected.

- Overlooking Riders: Riders are valuable add-ons that can significantly enhance your policy’s coverage. Be sure to evaluate them during your review.

- Ignoring Health Changes: If your health has improved or worsened, be sure to adjust your policy accordingly. An insurer may offer better rates based on improved health.

Final Thoughts: Stay Protected by Reviewing Your Life Insurance Regularly

Ensuring that your life insurance is up-to-date and tailored to your current needs is one of the most important steps you can take for your family’s future. If you’re unsure where to start or need assistance reviewing your coverage, our team of experts is here to help.

Contact us today to schedule a free consultation and discuss your life insurance options. We’ll help you assess your needs, compare policies, and make sure you’re fully protected—no matter what life throws your way.

Phone: (878) 778-8646

Don’t leave your family’s future to chance—let’s review your life insurance and ensure you have the right coverage today!