As a business owner or manager, hiring the right talent is crucial for your success. But did you know that you could also benefit from tax savings when hiring individuals from certain targeted groups? The Work Opportunity Tax Credit (WOTC) is a valuable incentive that can reduce your business’s tax liability by as much as $2,400 for most eligible employees—sometimes even more for certain groups.

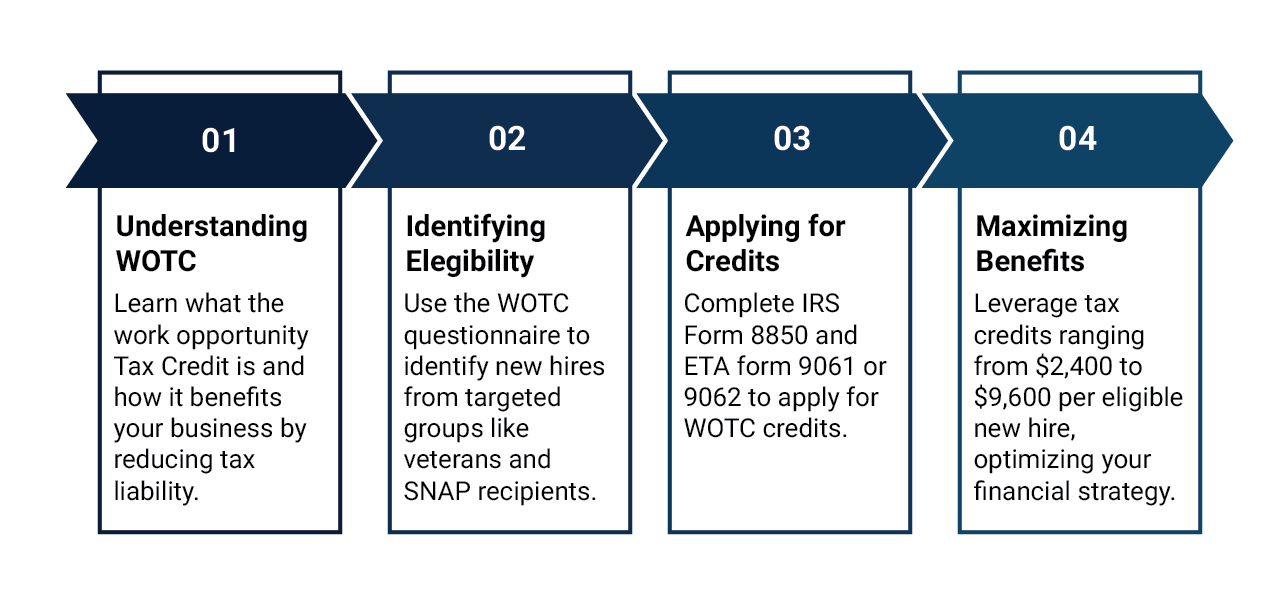

In this guide, we’ll walk you through everything you need to know about the WOTC and how it can work for your business.

What is the Work Opportunity Tax Credit (WOTC)?

The WOTC is a federal tax credit that encourages employers to hire individuals from specific groups that face significant barriers to employment. This incentive not only helps businesses reduce their tax bills but also promotes diversity and inclusion in the workforce. Employers can claim the WOTC for hiring individuals who are members of any of the following targeted groups:

- Temporary Assistance for Needy Families (TANF) recipients

- Qualified veterans (including disabled veterans)

- Ex-felons re-entering the workforce

- Designated community residents (living in Empowerment Zones)

- Vocational rehabilitation referrals

- Qualified summer youth employees

- Supplemental Nutrition Assistance Program (SNAP) recipients

- Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Long-term unemployed individuals (unemployed for at least 27 weeks)

This program aims to incentivize employers to provide job opportunities for individuals who might otherwise have difficulty finding employment, helping reduce long-term unemployment and welfare dependence.

For a comprehensive breakdown of the WOTC eligibility criteria, check out the IRS Guide on the Work Opportunity Tax Credit.

How Does the WOTC Work?

Eligibility for Employers

Employers can claim the WOTC for wages paid to qualified employees who meet the following criteria:

- The Employee Must Be From a Targeted Group: To qualify for the credit, an employee must be part of one of the listed groups above.

- The Employee Must Start Work Before January 1, 2026: The WOTC is currently set to expire at the end of 2025, so eligible employees must begin work before January 1, 2026, to qualify.

- Certification: Employers must obtain certification that the new hire is a member of one of the targeted groups. To do this, the employer submits Form 8850, the Pre-Screening Notice and Certification Request, to their state workforce agency within 28 days of the employee starting work.

Important: If you don’t submit Form 8850 on time, you won’t be able to claim the credit.

For further details on the certification process, visit the IRS page on Form 8850.

WOTC Credit Amounts

The WOTC credit amount varies depending on the targeted group the employee belongs to, and can range from $1,200 to $9,600 per employee. Here’s a breakdown of the credit amounts:

- $2,400 for most eligible employees (e.g., TANF recipients, ex-felons, and other general groups)

- $4,000 for long-term family assistance recipients

- $4,800 to $9,600 for certain veterans (disabled veterans and other specific categories)

- $1,200 for summer youth employees (working during a 90-day period between May 1 and September 15)

The maximum credit is generally available for first-year wages, but there are additional credits for second-year wages in some cases. For instance, long-term family assistance recipients are eligible for a 50% credit on up to $10,000 of second-year wages, totaling a $9,000 credit over two years.

Who Can’t Claim the WOTC?

- Employers cannot claim the WOTC for employees who are related to the employer (such as a child or spouse).

- The credit is not available for employees who have previously worked for the employer or have been rehired after a separation.

How to Claim the WOTC

Once the employee has been certified as eligible for the WOTC, the employer can claim the credit on their federal income tax return. It is important to note that the WOTC credit is limited to the employer’s tax liability. In other words, the credit can’t exceed the amount of taxes your business owes.

Summer Youth Employees

Special rules apply to summer youth employees. These employees must work during a specific 90-day period between May 1 and September 15. The maximum credit for hiring summer youth employees is $1,200 per employee.

Additional Rules and Considerations

While the WOTC is a highly beneficial tax incentive, there are some important considerations to keep in mind:

- Alternative Minimum Tax (AMT): In some cases, the credit may be subject to the AMT, which could affect how much benefit you ultimately receive.

- State-Level Incentives: Some states may have additional programs or credits that can be used alongside the federal WOTC. Check with your state’s workforce agency for more details.

- Choosing Not to Claim: In some situations, employers may choose not to claim the credit. This could be because the credit is smaller than expected, or other strategic reasons.

If you’re unsure about whether the WOTC is right for your business or if you have any questions regarding your eligibility, it’s always a good idea to consult with a tax professional.

Why the WOTC is a Valuable Credit for Employers

For many employers, the WOTC provides an excellent opportunity to save money while also helping to employ individuals who may have otherwise faced challenges in the job market. Whether you’re hiring veterans, ex-felons, or individuals on public assistance programs, the WOTC helps reduce the financial burden on your business.

By actively utilizing the WOTC, you can reduce your business’s tax liability while also supporting diversity, economic inclusion, and workforce development.

Need Help with the Work Opportunity Tax Credit? Contact Us Today!

If you’re ready to take advantage of the WOTC or need assistance understanding how it applies to your business, we’re here to help. Our team of experts can guide you through the certification process, ensure you’re meeting all requirements, and help you maximize your tax savings.

Contact us today for a free consultation:

Phone: (878) 778-8646

Don’t miss out on this valuable tax credit! Let’s ensure you’re making the most of the WOTC while building a stronger, more diverse workforce.